Liquidity in Forex is used to explain the extent of exercise going down in the monetary market. This is essential if you trade completely different currencies, as a result of the variety of energetic traders shopping for and promoting a selected pair, e.g. EUR/USD, and the volume being traded is very important in a speculation-driven market. Liquidity depth refers to the provider’s capability to offer a major variety of buy and promote orders at varied worth levels while sustaining consistent spreads. Consistency means the supplier can maintain the identical level of liquidity at all times, ensuring smooth and efficient buying and selling. A liquidity provider by definition is a market broker or institution which behaves as a market maker in a selected asset class.

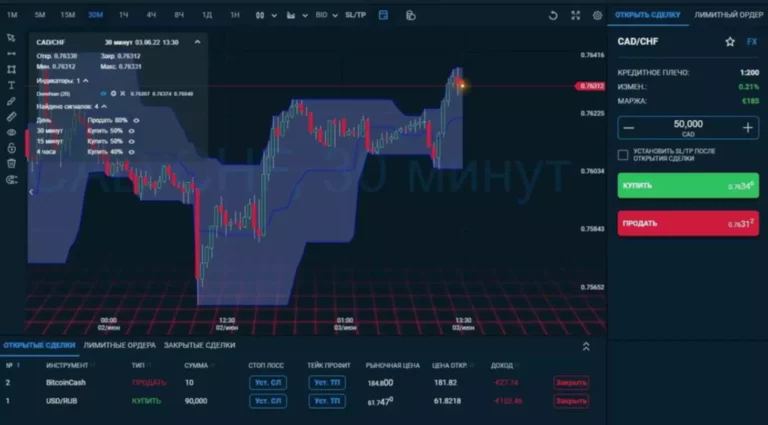

An growing variety of traders would like 24/5 access to main markets which, though fairly typical in Forex, is less ordinary with CFDs. A good buying and selling platform should be user-friendly and reliable and provide priceless tools and features. Researching and comparing totally different platforms offered by CFD liquidity suppliers is crucial for locating the one which most precisely fits your wants and preferences. It must be stable, trusted, and should have depth throughout multi-asset instruments.

How To Determine On The Best Crypto Cfd Liquidity Supplier

CFDs are a kind of economic by-product which have exploded in reputation among merchants of digital assets. A Crypto CFD is a contract for the distinction between the value of a cryptocurrency at the time of the contract’s execution and the worth of that cryptocurrency at a future date. CFD liquidity refers to the ease of shopping for or promoting a contract for distinction with out affecting its value, enabling fast and truthful execution of trades. It ensures merchants can enter and exit positions with minimal impression, reduces value manipulation risk and enhances market stability. Liquidity on foreign exchange market can be understood as the power of a valued merchandise to be transferred into forex in a sure time frame.

If you are planning to begin a foreign exchange brokerage or some other forex related business, you can see the expertise and solution suppliers right here. Liquidity is the lifeblood of any trading platform be it forex brokers or CFD brokers. If extra individuals commerce the EUR/USD foreign money pair and at greater volumes than the YEN/USD, it means the first has extra liquidity than the second.

Indeed, the CME Group lists two dozen Tier 1 FX liquidity suppliers, with over a hundred Tier 2 liquidity providers and aggregators. The most reputable liquidity providers fairly often have a set of FIX bridge suppliers already built-in into their buying and selling setting. The following beneficial list of qualification questions and considerations was created in order to assist a dealer https://www.xcritical.in/ to evaluate and select the best possible liquidity provider. For those looking to break into the true property business, Real Estate Investment Trusts (REITs) can present thrilling and rewarding career alternatives. Also, the downturns within the cryptocurrency market, including the FTX scandal and long-running crypto winter, have impacted liquidity demand.

Founded in 2014, Atomiq Consulting presents a whole white label resolution and liquidity package deal to entrepreneurs thinking about launching their own forex brokerages. Whether you could have a basic question about how liquidity works or are ready to get started, our staff of consultants can be found to debate all elements of our services with you in additional element. For all the conundrums, plunges, and institutional loss of belief, crypto is by now an integral part of brokers’ offerings. Besides the crypto-specific exchanges, conventional brokers supply crypto instruments to faucet into the lucrative trader base. Usually, pure retail brokers tap the providers of institutional brokers, also called prime of prime, to access liquidity. In a saturated market, due diligence makes for a big a part of the method.

Brokeree

“As a new technology of merchants and traders emerges, we’ve seen an astronomical increase in interest in cryptocurrencies and digital property at large”, said Trifonov. As a results of growing asset buying and selling activity and a growth in liquidity providers during the previous few years, brokerages now have access to an even bigger number of CFD liquidity providers to the advantage of their clients. Because every brokerage has a unique assortment of traits to consider, there isn’t cfd liquidity a “one-size-fits-all” method for figuring out probably the most applicable liquidity provider for a particular circumstance. Choosing probably the most appropriate liquidity partner on your agency could also be tough, given the big selection of financial institutions that provide this service. Making the right choice on your CFD liquidity provider requires asking and answering numerous important questions, which we’ll go over in detail as follows.

- Brokers depend on liquidity suppliers to provide smooth buying and selling circumstances and asset availability.

- Liquidity suppliers sometimes earn cash from the bid-ask spread – the difference between the buying worth and the selling value of an asset.

- Leverate, with 12 years of experience within the financial markets, presents enticing solutions for a variety of market players.

- GBE Prime has created a strong liquidity pool involving premier FX institutions globally.

Choosing a broker with renowned liquidity suppliers is a clever strategy to make sure you obtain the absolute best pricing and spreads and that slippage is minimized. Liquidity is the lifeblood of any monetary business, and choosing the proper liquidity supplier could make a significant difference in Crypto CFD buying and selling. Here are the top five suppliers which have carved a niche for themselves on this area. The right liquidity provider should have the power to execute trades swiftly with minimal slippage and requotes, especially throughout important information events that can set off speedy price actions.

Most merchants need and should care in regards to the liquid market because it is rather hard to handle danger if you’re on the incorrect facet of a big move in an illiquid market. Whatever the model and the liquidity kind brokers go for, choosing and maintaining the best companions is an arduous course of that can take months. Thanks to such LPs relationships, brokers can send their shoppers’ trades to the market (and gather a fee), in a Straight Through Process (STP) mannequin. They can even take the opposite side of the trade and make the market themselves (with many brokers combining the 2 in a hybrid model). The execution supplied by an LP must be fast (at least beneath 100 ms), with out rejects or requotes. The dependable partner should also supply time precedence execution and full post-trade transparency (MiFID compliant).

Regulatory compliance entails the supplier adhering to authorized and regulatory conditions, similar to risk administration, monetary reporting, and transparency in pricing. They must also comply with anti-money laundering (AML) and know-your-customer (KYC) laws to guard investors’ pursuits and preserve the integrity of the monetary markets. The high quality of the software and the correct trading course of significantly have an effect on the results. The level of assist and experience supplied by the supplier additionally impacts the time and effort required for establishing and operating a trading process. Though demand for buying and selling is growing, consolidation is happening within the liquidity house, as brokers only need to work with reputed names.

There are many issues for brokers, varying in accordance with their region, measurement, and ambitions. Some of the parameters are status, liquidity depth, pricing competitiveness, range of financial instruments, expertise infrastructure, and regulatory compliance. This progress exemplifies their key function within the FX (and CFDs) market structure, as the standard of liquidity that brokers get and consequentially deliver to traders is a critical side of the enterprise. A liquidity supplier who’s quoting instruments based on the provide of sure exchanges is obliged to have signed a market knowledge redistribution license agreement. Some of one of the best LPs have full packages of the market information able to be applied by their partners. It provides a substantial volume of crypto assets for buying and selling, contributing to market liquidity.

For instance, when a trader appears up the present price of EUR/USD, that fee has to be derived from some supply. In other instances, the pricing comes directly from a liquidity provider, which finally ends up in the second idea. Liquidity suppliers ought to provide steady and dependable feeds with none spikes or gaps on the charts. Feeds ought to mirror prices from the interbank foreign trade markets and underlying devices from a listing of stock exchanges.

Liquidity providers typically earn money from the bid-ask unfold – the distinction between the buying value and the promoting value of an asset. They may also obtain fees or commissions from each transaction using their liquidity. This refers again to the variety of purchase and sell orders at each price level for a specific cryptocurrency. A provider with substantial market depth will probably be extra stable and can higher accommodate massive orders without significantly affecting the price. Crypto CFD trading also addresses certain sensible limitations of conventional cryptocurrency buying and selling.

Tips On How To Pick Probably The Most Appropriate Cfd Liquidity Provider?

Firms that offer liquidity are known merely as liquidity providers or LPs. Some liquidity suppliers are very large institutions with places of work across the globe, while others are smaller sized companies catering to a selected kind of client or industry niche. Finally, some foreign exchange brokers serve a twin functions offering liquidity as nicely. If you want to start your own forex brokerage, deciding on a liquidity provider is similar to the decision making process that merchants face when choosing their foreign exchange broker of alternative. In brief, figuring out which liquidity provider to associate with requires careful thought and consideration.

Both brokers and liquidity suppliers agree that every dealer should have a main liquidity supplier and a minimal of one backup. This also can get rid of the challenges during market volatility when spreads widen. Hence, for any monetary institution operating within the crypto or foreign exchange landscape, figuring out the proper liquidity supplier is not only a aim – it’s a necessity. It’s the crucial first step to set the stage for a successful, profitable trading operation. So, conduct extensive research, scrutinize your choices, and choose a liquidity supplier that best aligns with your small business mannequin and clients’ needs.

B2broker Liquidity

X Open Hub links brokerage businesses to over 3000 devices by connecting them to intensive institutional liquidity swimming pools. For CFD contracts on cryptocurrencies, their pool consists of pairs with seven digital property, together with BTC, ETH, LTC, XRP, DASH, EOS, and XLM. They boast industry-leading execution speeds, and their pricing constructions swimsuit STP and ECN brokerage companies. Locating trustworthy liquidity suppliers is a important first step in launching a Crypto CFD brokerage.

This just isn’t so much a list of traits however a framework to get the ball rolling and you can ask the right questions when deciding on a dealer liquidity supplier Forex. According to the Oxford dictionary, the first definition of liquidity is “the availability of liquid assets to a market or company”, being liquid belongings understood right here as “cash”. Cash is thus seen to be as useful as a liquid therefore the time period “liquidity”. But, as you know, within the Forex or LXCapital, liquidity has a selected meaning, and ours is a unique liquid. Customer help and repair high quality can vary considerably between suppliers, so it is essential to analysis and evaluate their options earlier than using their services.

A thorough risk management method consists of regular audits, robust cybersecurity, and clear trading instructions. Depending on the jurisdiction in which you propose to conduct enterprise, cryptocurrency and CFD trading will be topic to various rules. Obtaining the suitable authorizations and assembly the requisite authorized requirements are fundamental. CFDs thus allow buyers to evaluate rising and falling markets, in addition to to trade with margin/leverage. They are traded in dozens of markets, and in addition to money and futures merchandise, they’re available for commodities similar to gold and oil, stocks and indices. If you would possibly be planning to begin out a CFD Brokerage Business and contemplating running it on A Book the place you’d ship your shoppers trades for execution to a 3rd celebration, CFD Liquidity Providers are your best option.

The provider’s knowledge feeds ought to be steady and dependable and supply real-time value information from all relevant exchanges and Forex. Any delays may end up in worth gaps, adversely affecting trade execution and profitability. Making positive the liquidity supplier helps all kinds of cash and tokens is crucial. This selection allows the brokerage to serve a variety of consumers with different trading preferences.

Contracts for distinction (CFDs) are a easy and cost-effective way to trade on a variety of financial markets without the necessity to personal the underlying asset. They are successfully an agreement between two parties, i.e. the dealer and the CFD supplier, to trade the distinction between the opening and shutting value of a contract. In current years, they’ve turn out to be a well-liked means for merchants to diversify into different international markets. Liquidity is a serious downside for brokers who present CFD buying and selling companies. The best method to make an educated decision is to research and contrast the benefits of numerous liquidity suppliers.